Home

General Father

5 Financial Moves You Must Make Before Your Baby Arrives

In this Article

General Father

5 Financial Moves You Must Make Before Your Baby Arrives

Updated on 18 March 2023

Nothing gives more happiness to a couple than the fact that they are all set to welcome a baby into their lives. Along with the moment of happiness, it should also be a movement of financial planning for the growing family.

If you do proper financial planning for the coming child in time, you will become responsible and happier parents. It can give your child a financially secure and happy life. Moreover, you get a chance to give your baby a better future to your survivors as well as become a good person. However, a better future for your baby is possible only with timely financial planning.

You may also like to read: 5 finance management tips for new parents

Financial Planning to Consider for Your Growing Family

Here are five important financial planning moves you must consider making before your little one arrives for a stress-free and financially secure life ahead:

1. Check Your Finances Closely

If you are expecting a child, then you must take care of your financial status first. You should thoroughly analyze your income, expenses, debts, and other financial obligations. Make a personal budget so that you can plan better savings to pay for your child's expenses. You can check your finances based on your assets and liabilities.

2. Review your parental leave

If you are working then you must also review Maternity and Paternity Leave. Most companies in India offer paid maternity leave for 180 days but only a few offer paid paternity leave. So, it's important to enquire about the provisions for parental leave in your organisation. And if you have to take some unpaid time off, then you must plan accordingly.

3. Brush up your insurance expertise

If you are bringing a new life into this world, then it's essential to insure the new life too. You can choose a suitable insurance policy for your upcoming child, and make a proper payment arrangement for the instalments. It can pay you 50-100% of the earnings lost during pregnancy and childbirth.

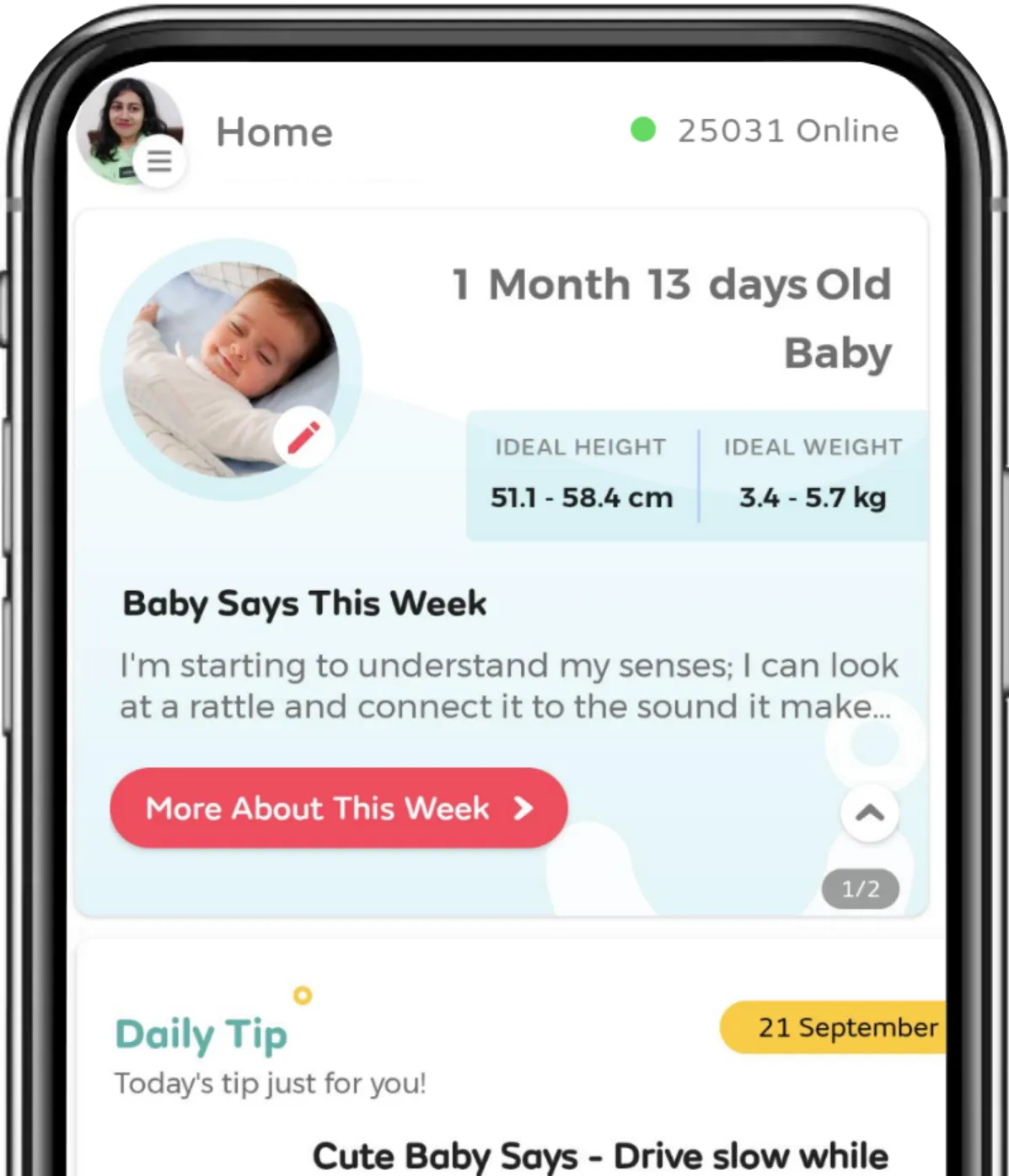

4. Make a proper baby budget

If you have proper knowledge about your financial health and childbearing expenses, then you can make it a part of your financial plan by making a proper budget for that too. You can also use Mylo's helpful baby expenditure tool to keep a track record of all your baby's expenses. This will not only give you financial insight into your life with a baby but also help you track and minimise your expenses.

You may also like to read : How does practicing Garbha Sanskar during 9 months of pregnancy help women deliver a healthy baby?

5. Start saving for your child's education

While it may not feel like an immediate priority, the sooner you start saving for your child's school and college tuition, the more options your child will have. A common way to save for kids’ education is by investing in tax-advantaged savings plans. So, start researching and begin investing as soon as you find an appropriate investment avenue for your family.

Becoming a parent is the most challenging and life-changing event of anyone's life. You are not only responsible for yourself and your partner but also for a little one. To give a better nay the best life to your child, you must make proper financial planning for your growing family.

Written by

Ishmeet Kaur

Ishmeet is an experienced content writer with a demonstrated history of working in the internet industry. She is skilled in Editing, Public Speaking, Blogging, Creative Writing, and Social Media.

Read MoreGet baby's diet chart, and growth tips

Related Articles

RECENTLY PUBLISHED ARTICLES

our most recent articles

General Father

Daddy-Baby bonding from Pregnancy to Childbirth: Top 7 tips for you

General Preschoolers

How to prepare your child for pre-school

Celebrate Breast Feeding Week

I am pregnant, can I still breastfeed my toddler?

Daily Care Tips

My toddler has bad breath. what should I do?

Growth & Development

When will my toddler learn how to scribble or draw?

Hearing Problems

Can loud volume affect my toddler's ears?

- Running & Jumping Milestones for your toddler

- Activities to keep an active toddler occupied at home

- Girls' growth chart: 24 to 36 months

- What to do if your toddler is overweight?

- Electric toothbrush for Toddlers: Is it safe?

- Teaching good eating habits to your kids

- How to Introduce Books to Your Child?

- This is how you can talk to your child about strangers

- A healthy meal plan for your 2-year-old

- Music In Pregnancy: How Does Music Affect Your Baby’s Brain

- What is the importance of measuring basal body temperature during conception?

- Signs That Children Are Ready for Potty Training

- Physical Development In Early Childhood

- What Is Social Development in Early Childhood?

AWARDS AND RECOGNITION

Mylo wins Forbes D2C Disruptor award

Mylo wins The Economic Times Promising Brands 2022

AS SEEN IN

- Mylo Care: Effective and science-backed personal care and wellness solutions for a joyful you.

- Mylo Baby: Science-backed, gentle and effective personal care & hygiene range for your little one.

- Mylo Community: Trusted and empathetic community of 10mn+ parents and experts.

Product Categories

baby carrier | baby soap | baby wipes | stretch marks cream | baby cream | baby shampoo | baby massage oil | baby hair oil | stretch marks oil | baby body wash | baby powder | baby lotion | diaper rash cream | newborn diapers | teether | baby kajal | baby diapers | cloth diapers |